Why Dental Insurance Verification Matters: Safeguard Your Practice and Enhance Patient Care

In today’s fast-paced dental industry, efficiency and accuracy are crucial for a successful practice, and dental insurance verification plays a key role. Accurate insurance details not only protect a dental office's financial health but also enhance the patient experience by reducing administrative distractions.

Without proper insurance verification, your office risks unpaid claims, delayed reimbursements, and dissatisfied patients. A strong insurance process minimizes these issues, builds patient trust, and clarifies financial expectations.

Protecting Your Practice: Why Insurance Verification is Crucial

Every dental practice must balance financial security with providing quality care, and dental insurance verification is key to achieving this. Accurate verification ensures time payments, keeping your bottom line financially stable. When mistakes are made, this not only disrupts cash flow but also harms patient relationships.

Let’s take a real-world scenario: A dental practice provides treatment to a patient believing that their insurance will cover 80% of the cost. However, due to inaccurate verification, the insurance provider only covers 50%, leaving the patient with a higher out-of-pocket cost than anticipated. The result? A dissatisfied patient, billing complications, and the potential loss of future business. All of this could be avoided with thorough insurance verification.

By accurately verifying patient insurance details upfront, you achieve several important goals:

- Prevent claim denials: Ensuring coverage details are accurate before treatment eliminates surprises. For example, if your office routinely verifies insurance, it stays ahead of costly surprises like finding out a particular procedure isn’t covered after it's performed.

- Reduce accounts receivable days: Faster, more accurate claims lead to quicker payments from insurance providers. Consider the difference between a provider that verifies insurance daily and one that doesn’t. The former gets paid in 30 days or less, while the latter often waits 60+ days due to rejected or delayed claims.

- Avoid costly write-offs: Incorrectly assuming coverage can lead to cost absorption because patients can't pay. Imagine performing a high-cost oral surgery under the assumption it's covered, only to later realize the insurer pays a fraction of the cost. The difference could mean thousands in lost revenue.

- Minimize patient disputes: Patients are more likely to pay and trust their dentists when coverage is confirmed, and costs are discussed upfront. Discussing coverage limitations ahead of time reduces billing complaints and patient dissatisfaction.

- Improve overall cash flow: With insurance verification, your billing team can prevent revenue bottlenecks that happen when claims are rejected. By ensuring coverage is correctly applied, your revenue cycle flows smoothly.

A strong insurance verification process protects the practice's bottom line, improves practice efficiency, and strengthens the relationship with patients. When financial issues are minimized, dental practices can focus on providing excellent care, ultimately enhancing both patient outcomes and revenue stability.

Enhancing Patient Care Through Insurance Verification

An efficient insurance verification process doesn’t just benefit the financial side of the practice—it significantly enhances patient care as well. Consider a patient scheduled to have braces installed and their coverage was verified incorrectly or the benefits were misinterpreted. This situation translates into significant out-of-pocket costs they weren’t prepared for and may lead to a delay or cancellation of necessary treatment.

Dental patients who are confident that their insurance coverage is handled correctly will follow through with their oral healthcare plan without worrying about unexpected expenses. This sense of security leads to higher satisfaction, directly impacting loyalty and retention with your brand.

A properly functioning verification process ensures that:

- Patients receive accurate estimates of their financial responsibility during case presentations, preventing unexpected bills and allowing them to plan ahead.

- Procedures are not delayed due to confusion over coverage, ensuring that patient care plans stay on track and reducing unnecessary rescheduling.

- Operational efficiency is improved, which reduces wait times, speeds up appointment scheduling, and enhances patient convenience.

- Administrative errors are minimized, leading to fewer billing issues and faster claims processing, which ensures a smoother experience for patients.

- Treatment plans are aligned with insurance coverage, allowing patients to maximize their dental benefits, and reduce unexpected out-of-pocket costs.

- Patients are more likely to comply with treatment when they understand their financial obligations upfront, improving both oral health outcomes and patient satisfaction.

- Practice staff can focus more on patient care instead of being tied up with insurance complexities, improving overall patient interactions and service.

- Patients feel more confident in the practice’s transparency, strengthening trust and fostering a stronger patient-provider relationship.

Insurance verification is essential to provide clarity that reduces financial stress for patients. This leads to smoother appointments, timely treatments, and stronger trust.

Creating a Sound Dental Insurance Verification Process

Building a robust dental insurance verification process involves several key steps, from manual processes to automated software solutions. Let’s explore these approaches.

Traditional Methods of Insurance Verification

Historically, dentists have relied on manual methods to verify insurance coverage. These processes typically involve:

McLemore Dentistry cuts no-shows by 33% in the first 6 months with Adit Looking to reduce no‑shows and streamline communication without adding more work? Before Adit, McLemore Dentistry used DemandForce for its primary communications...

Download Case Study- Calling insurance providers: Reception staff or billing coordinators would call insurance companies directly to confirm coverage details, often navigating through lengthy automated systems and hold times, leading to inefficiencies.

- Verifying online portals: Some insurance companies offer online portals where practices can log in and check patient coverage. However, this often requires multiple logins and navigating different interfaces, which can be time-consuming.

- Faxing or emailing for verification forms: Practices would frequently fax or email patient information to insurers and await a confirmation. This method can lead to delays if forms are lost or not processed quickly.

- Relying on insurance cards: Many practices depend on patients presenting their insurance cards at the time of service. This method is risky because it relies on patients to keep their information up-to-date, leading to potential inaccuracies.

- Manual cross-checking with past claims: Staff may spend time manually cross-referencing previous claims to determine coverage, which can be inefficient and prone to error if there have been changes in policies or coverage.

- In-person verification: Some practices may ask patients to verify their insurance during their appointment, which can create confusion and lead to billing surprises if the verification is inaccurate.

While these methods are effective, they are time-consuming, prone to human error, and can quickly overwhelm staff when handling high patient volumes. As a result, these inefficiencies impact both revenue cycle management and the patient experience.

Modernizing the Process with Dental Insurance Verification Software

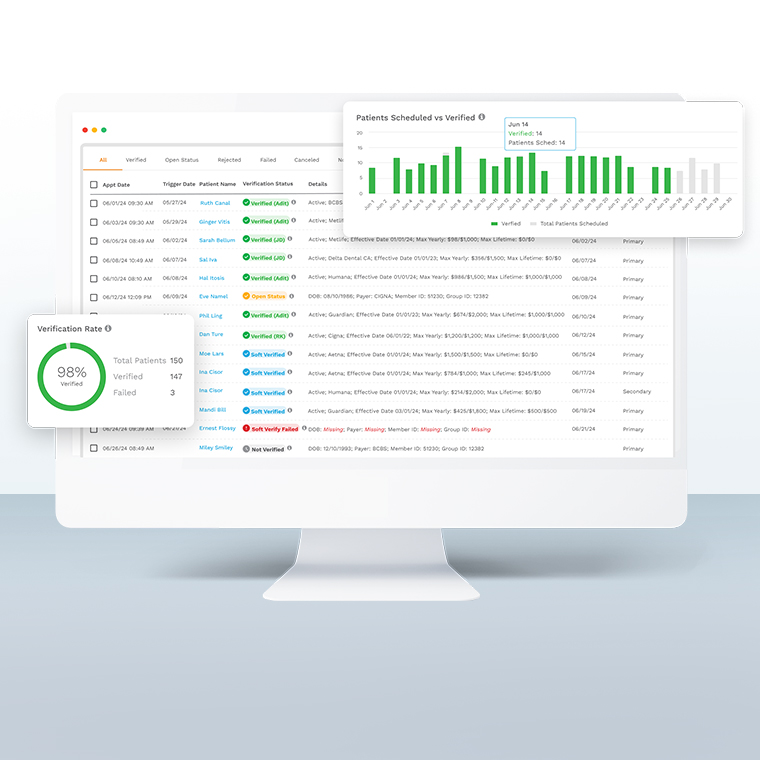

Thanks to comprehensive dental software solutions like Adit, practice owners now have access to automated tools that streamline the verification process by automating routine insurance-related tasks.

The benefits of using insurance verification software include:

- Real-time insurance verification: Software provides immediate access to up-to-date insurance information, ensuring accuracy. For instance, practices no longer need to call or check multiple portals for verification—they get instant confirmation.

- Reduced administrative workload: Automated systems handle the majority of verification tasks, freeing up staff to focus on patient care. Staff can spend less time on the phone with insurance companies and more time assisting patients with treatment plans or scheduling.

- Improved patient satisfaction: Faster verification means patients aren’t left waiting for answers on coverage or costs. A practice can give a patient a breakdown of their benefits in real-time, reducing frustration and uncertainty.

- Minimizing human errors: Automated software greatly reduces the risk of manual errors, such as misentering insurance information, leading to fewer claim denials.

- Seamless integration with other practice management tools: Insurance verification software can integrate with online scheduling, billing, and treatment planning tools, creating a cohesive workflow that enhances practice efficiency.

- Faster claims processing: Accurate and quick insurance verification ensures claims are submitted correctly the first time, speeding up the reimbursement process.

- Elimination of coverage gaps: Software identifies potential coverage gaps early on, ensuring that patients are informed if they need to pay out-of-pocket for specific services.

- Enhanced financial forecasting: With verified insurance information, practices can predict patient payments and insurance contributions more accurately, leading to better financial planning.

- Boost in staff productivity: When staff are no longer bogged down with time-consuming verifications, they can focus on improving patient care and administrative efficiency.

- Compliance and security: Many dental insurance verification software systems are designed to comply with HIPAA regulations, ensuring that sensitive patient data is handled securely.

Your busy dental practice needs an insurance verification process that can reduce the time it takes to verify and submit claims from hours to minutes. Why keep your team juggling multiple calls or logging in to numerous portals? Instead, reclaim this wasted productivity to focus on more patient-centered tasks.

How to Build a Best-in-Class Insurance Verification System

Incorporating insurance verification software into your dental office is key, but creating a truly efficient system requires additional strategies. Here are some essential steps to help build an effective process:

- Train your staff: Ensure that team members are well-versed in using insurance verification tools. Proper training should focus on maximizing the software’s capabilities and handling any potential verification issues efficiently. A well-trained team significantly reduces claim errors.

- Streamline workflows: Integrate your verification software with advanced practice management and billing systems. This not only speeds up the verification process but also ensures that all patient insurance data flows seamlessly across systems, reducing manual entry errors and improving overall accuracy.

- Stay updated on insurance policies: Insurance policies frequently change, and a best-in-class system should be capable of automatically handling these updates. Keeping your team informed about changes in coverage and policies can prevent claims denials and patient billing surprises.

- Maintain thorough documentation: Always document insurance verifications thoroughly, ensuring that accurate information about patient eligibility, deductibles, and co-pays is readily available. This minimizes discrepancies between your office, patients, and insurers.

- Set clear communication protocols with patients: Once insurance coverage is verified, communicate with patients upfront about their coverage, co-pays, and any potential out-of-pocket costs. Clear communication helps prevent confusion and builds trust between patients and the practice.

- Create a pre-verification process: Implement a system for verifying insurance before the patient’s appointment. This ensures that any coverage issues are addressed before the patient arrives, minimizing delays and enabling smoother workflows.

- Use practice analytics to refine the process: Use data analytics and reporting tools to analyze the efficiency of your insurance verification process. Regularly review denial rates, reimbursement times, and patient satisfaction to identify areas for improvement.

- Collaborate with insurance providers: Build strong relationships with key insurance providers to streamline the verification process and troubleshoot any issues that arise more quickly. Regular communication can help resolve claim discrepancies more effectively.

By focusing on staff training, streamlined workflows, patient communication, and leveraging technology, your dental practice can create a verification system that protects your revenue and enhances patient care.

Why Adit is the Best Solution for Insurance Verification

An efficient insurance verification process is not just an administrative task—it’s an essential component of safeguarding your practice and improving patient care. With Adit's Insurance Verification software, you can reduce financial risks and provide a better patient experience.

Our dental software offers a comprehensive suite of dental practice management integrations designed to enhance both the administrative and patient care aspects of your clinic. If you're looking for a seamless integration experience, you'll love what we have to offer:

- Adit Pay: Streamlined billing and payment solutions that integrate with insurance verification.

- Adit Voice: Advanced call tracking and recording to monitor patient interactions in one centralized location.

- CareCredit Integration: Offering qualified patients more payment flexibility for uncovered costs.

- Patient Text: Convenient SMS texting integration to remind patients about appointments and financial responsibilities.

- Appointment Reminders: Automated notifications to reduce no-shows and keep your schedule full.

- Practice Analytics: Real-time data insights into your practice’s financial health and patient care.

- Patient Recall: Automating the process of bringing back patients for routine care.

- Telemed: Virtual consultations to improve accessibility and convenience.

- Inhouse Chat: Secure messaging for internal team communication.

- Treatment Planning: Digital plans that integrate seamlessly with patient coverage.

- Pozative Reviews: A platform to gather positive patient reviews, boosting your practice’s reputation.

- Online Scheduling: Allowing patients to book appointments online with insurance verification included.

- Patient Forms: Digital forms that integrate directly with your software to speed up insurance verification.

- Email & eFax: Streamlined communication and document management.

- Digital Marketing Support: Boosting your practice's online presence.

- Dental Website Design: Custom-built websites that integrate with all your software features.

- Mobile App: A centralized hub for patients to manage appointments, payments, and insurance details.

Say goodbye to constant claim denials and backlogged reimbursement requests. Let our 17+ integrated features help your dental employees take control of the chaos. Book a free demo today!

more about Adit?

Say goodbye to the hassle of using multiple tools. Adit centralizes your calls, texts, payments, reviews, and scheduling into one powerful dashboard. Simplify your operations and boost patient satisfaction today.

Schedule a DemoAngela is a former English teacher turned marketing content specialist. Over the past 10 years, she’s developed marketing strategies to forge enduring bonds between B2B, B2C and SaaS companies and their clients through holistic education, effective communication, and captivating storytelling that moves audiences to act.

Get a $25 Gift Card when you take a demo

Schedule a DemoGet a $50 Gift Card

when you take a demo

Looks like you're out of bounds!

Hey there! Your current location falls outside Adit's area of operation. If this is unexpected, try disabling your VPN and refresh your page. For further assistance or to book a live demo, connect with us at 832-225-8865.

February 17 Amazon Demo Promo

Terms and Conditions

Last Updated: February 17, 2026Offer ends February 20, 2026, and is limited to prospective customers who sign an annual agreement before February 28, 2026. Gift card will be emailed to the company owner or established representative within 4 weeks of signing the annual agreement. Offer may not be combined with any other offers and is limited to one (1) gift card per office. Offer is not available to current customers or to prospective customers or individuals that have participated in a Adit demo during the prior six (6) months. Recipient is responsible for all taxes and fees associated with receipt and/or use of the gift card as well as reporting the receipt of the gift card as required under applicable federal and state laws. Adit is not responsible for and will not replace the gift card if it is lost or damaged, is not used within any applicable timeframe, or is misused by the recipient. Adit is not responsible for any injury or damage to persons or property which may be caused, directly or indirectly, in whole or in part, from the recipient’s participation in the promotion or receipt or use of the gift card. Recipient agrees to indemnify, defend and hold harmless Adit from and against any and all claims, expenses, and liabilities (including reasonable attorney’s fees) arising out of or relating to a recipient’s participation in the promotion and/or recipient’s acceptance, use or misuse of the gift card. This offer is sponsored by Adit Communications, Inc. and is in no way sponsored, endorsed or administered by, or associated with Amazon.

Thank You!

We appreciate your interest! Adit AI will be calling you in the next few minutes!

Why Adit?

Cut your software bill by up to 60% when you merge everything your dental office needs to run under one roof.

Centralize Communications

- Phones & TeleMed

- Emails & eFax

- Texting & Reminders

- Call Tracking and more!

Streamline Operations

- Patient Forms

- Online Scheduling

- Payments

- Reviews and more!

Boost Production

- Performance Dashboards

- Morning Huddle

- Claims & Collections

- Patient Profiles

- Follow Up Lists

- Year Over Year Metrics

Acquire More Patients

- Digital Marketing

- Website Design

- SEO

- Google Ads

- Facebook Ads

when you sign up with Adit!

Sign up by filling out the form